PPC reports a 20.6% boost in revenue thanks to Zimbabwe business

Cement company PPC has reported a 20.6% year-on-year increase in revenue to about R10-billion for the financial year ended March 31, compared with the R8.3-billion in revenue reported for the prior financial year.

At the release of its financial results, on June 24, the company said this growth was primarily driven by the company's performance in Zimbabwe.

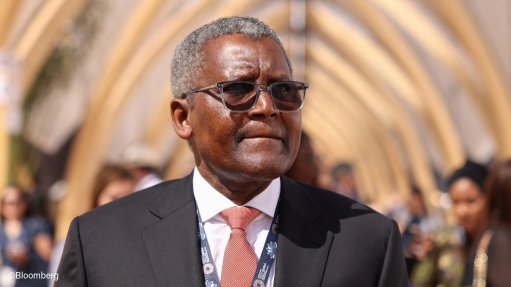

However, PPC CEO Matias Cardarelli told Engineering News that a unique set of once-off circumstances led to the strong Zimbabwe performance and that it was likely to repeat in future. These included being able to restarted the Zimbabwe kiln, a temporary cement shortage in the country owing to a main competitor’s operational problems, and a government-imposed limitation on cement importation.

“All three at the same time, we don't see happening again. The results in Zimbabwe were positively impacted by situations that we don't see repeating again in the short term. Rather, we need to look internally,” he said.

Despite a decline in group sales volumes, with muted demand for cement in the South Africa and Botswana businesses, the company said it remained resilient in the evolving cement industry and poised for change.

An ordinary dividend of 13.7c a share has been declared based on a passthrough of the Zimbabwe dividend received during the year.

"These results were positively impacted by the Zimbabwe performance, while our South African and Botswana businesses did not perform to their full potential. This is a critical moment for PPC as our prolonged underperformance calls for us to make strategic decisions, shift our focus and strengthen our core operations.

“We have begun an organisational reset and turnaround to address the declining performance across the group. The newly reorganised executive committee team will lead the transformation of the company’s internal operations.

“Despite these challenges, we believe that, with our strong asset base, the right people and a solid balance sheet, we can capitalise on these internal opportunities to drive value creation,” Cardarelli said.

Meanwhile, group cost of sales increased by 16.3% to about R8.4-billion, up from about R7.2-billion last year. All of the increase in cost of sales is attributable to Zimbabwe, with the South Africa and Botswana group’s cost of sales having declined marginally by 1.3% or R73-million, driven by lower sales volumes.

Group administration and other operating expenditure increased by 5.5%. Group earnings before interest, taxes, depreciation and amortisation (Ebitda) margin therefore improved to 12.3% from 10.7% in 2023.

However, Cardarelli said that the company urgently needed to improve its management account information.

“Currently, the company is lacking accurate information about many of the most important indicators of our business. That prevents management from taking appropriate decisions. So we are working a lot on rebuilding the management account system in the company to be able to take better decisions in the future,” he said.

Trading profit increased by R502-million to R619-million from R117-million. Of the R502-million increase, R395-million was attributable to Zimbabwe.

Depreciation for the group decreased by R155-million to R623-million from R778-million last year. The most material contributors to the decrease were PPC Zimbabwe and South Africa and Botswana cement.

Owing to the change in the functional currency for PPC Zimbabwe from the Zimbabwean dollar to the US dollar, hyperinflation accounting is no longer applicable, which resulted in a decrease in property, plant and equipment and an associated decrease in depreciation by R86-million.

South Africa and Botswana cement also had a decrease in depreciation of R57-million, mainly owing to the extension of useful lives of certain of the assets.

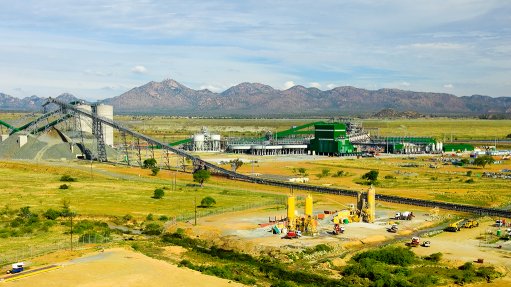

“Most of our kilns are operating below rate capacity. So we think we have a challenge there in terms of performance and reliability, and we need to look carefully at that. I think that we have a good opportunity to increase our coprocessing. We are the lowest cement producer in the country in terms of coprocessing rates. That would be very good, not only for reducing costs, but also for our CO2 emissions,” Cardarelli said.

He added that, to further improve the balance sheet, the company was looking at taking more control over its logistics.

“Our logistics operations are completely outsourced. The supplier is running our logistic operation, so that means the most important input cost nowadays is fully controlled by suppliers. So we are looking at engaging in productive conversations with the current suppliers, and we are looking at taking more control of that,” Cardarelli explained.

Given the movements in trading profit and depreciation, group Ebitda increased by 38.6% to about R1.2-billion from R896-million in 2023.

The fair value and foreign exchange gains movements changed from a gain of R55-million in the 2023 financial year to a charge of R30-million in the current year. In the prior year, US dollar debtors were remeasured into Zimbabwean dollars creating significant exchange gains. This is no longer applicable given the change in functional currency.

The prior year’s net monetary loss arising from hyperinflation accounting for PPC Zimbabwe of R131-million is therefore no longer applicable in the current year, the company said.

In the prior year, the credit risk adjustment on the intrinsic value of the blocked funds was taken to 100%, resulting in a fair value loss of R32-million. Accordingly, there was no current period fair value loss. A significant increase in impairments to R267-million from R61-million a year prior in the current year relate primarily to property, plant and equipment as muted market volumes are expected to persist and there is a need for capacity and cost optimisation going forward.

Consequently, it was decided to mothball the Jupiter milling plant at an impairment of R56-million and the Slurry and Dwaalboom swing kilns for an impairment of R125-million, although all these assets remain readily available for recommissioning should volume demand be there.

Further, given the muted demand experienced by the aggregates business, which is not expected to change materially in the future, an impairment of R70-million was taken on the aggregates assets, PPC reported.

The prior year’s impairment related primarily to impairments in the readymix business.

Finance costs, meanwhile, increased marginally to R131-million from R123-million in 2023.

Although South Africa and Botswana debt levels were lower in the current year, interest rate increases resulted in interest paid on borrowing increasing by R6-million.

In addition, a higher level of capitalised leases resulted in an increase in this interest charge of R6-million.

The balance relates to time value of money adjustments of rehabilitation and decommissioning provisions. Investment income increased to R42-million from R26-million last year, on higher cash balances earning a higher interest rate in South Africa.

"We have achieved modestly improved results, considering the decline in performance across the operations in the second half of the year. The internal focus areas are expected to unlock value and improve margins,” PPC CFO Brenda Berlin added.

Cement revenues in South Africa and Botswana increased by 5.2%, mainly owing to a 9.7% increase in average prices over the prior year and higher sales of clinker to Zimbabwe, offsetting the lower cement sales volumes.

However, revenue from the materials businesses declined by 6.9% compared with the prior year.

There was a notable increase in impairments owing to the muted market outlook in South Africa, leading to a decision to mothball certain assets, the company said.

Total group capital expenditure rose marginally to R400-million, slightly below the planned spend.

Headline earnings per share (HEPS) and earnings per share (EPS) increased notably, with HEPS of 19c, compared with a loss a share of 20c in the prior year. EPS improved to 6c a share, from a loss of 21c a share last year.

The company also completed a successful share repurchase programme and reduced bank debt in the South Africa and Botswana operations.

“In a challenging market impacted by imports and some low-quality blended local cement, industry discipline is required to prioritise margins and profitability. Industry dynamics should evolve from a focus on maximising volumes to now needing to prioritise margins for long-term sustainability and investor returns.

“We have a clear and bold plan for recovery focused on both fixing and rebuilding while also pursuing quick wins. Our strategic plan focuses on working capital management, a contribution margin approach, improving industrial performance, enhancing the go-to-market and the logistics operating model.

“Our short-term strategic focus on internal reorganisation will pave the way for growth in the next phase. This will entrench our position as the premier cement company in Southern Africa, well positioned to take advantage of value accretive growth opportunities,” Cardarelli said.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation