Long-term unlocking of vast resources potential gaining ground

MOZAMBIQUE POTENTIAL Mozambique continues to attract international interest and aims to bolster its position as a key mining hub in Southern Africa

GEERT KLOK Mozambique’s mining legislation is designed to provide stability and attract long-term investments

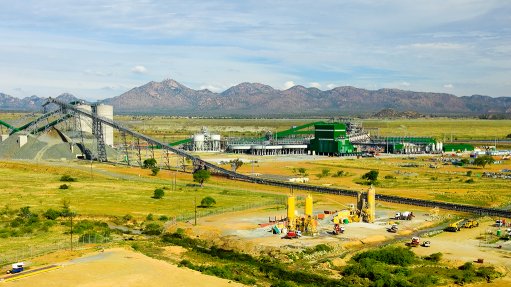

Mozambique’s mining industry has been a significant driver of economic growth over the past two decades. With vast mineral resources, including heavy sands, coal, magnetite, graphite, lithium, gold and gemstones, the country offers a promising landscape for mining investments, says mining industry representative organisation Mozambique Chamber of Mines (CMM) chairperson Geert Klok.

He adds that despite challenges, Mozambique continues to attract international interest and aims to bolster its position as a key mining hub in Southern Africa.

“Most of Mozambique’s mineral wealth remains unexplored, which offers plenty of opportunities for new players entering the industry,” highlights Klok, adding that the country’s strategic location on the Indian Ocean seaboard, with a 2 500 km coastline, enhances its appeal and export potential.

In addition, well-established transport corridors, such as the Maputo Corridor, Beira Corridor and Nacala Corridor, link Mozambique to neighbouring countries, facilitating the movement of goods and resources.

Mozambique also benefits from the expertise and mining suppliers available in neighbouring South Africa – a long established mining jurisdiction – further strengthening Mozambique’s mining ecosystem.

It is for these reasons, as well as others, that the CMM advocates taking a long-term view and planning accordingly when it comes to adopting ancillary legislation “so that the rules of the game are not changed to the detriment of the industry”, says Klok.

He explains that Mozambique’s mining legislation is designed to provide stability and attract long-term investments.

The current Mining Law, which came into force in 2014, replaced the 2004 Mining Law, establishing a stable core of mining regulations.

Relatedly, in 2022, the Mozambique government introduced the Package of Economic Acceleration Measures to improve the business environment.

“These measures aim to reduce bureaucracy and enhance economic efficiency, though specific initiatives to strengthen the mining sector are still needed,” notes Klok, adding that the CMM has called for the inclusion of the mining industry in future economic packages, highlighting the importance of addressing industry-specific challenges.

Overall, he notes that mining companies have generally welcomed the government’s efforts to improve the business environment; however, Klok notes there remain concerns about the implementation of certain measures.

For instance, he points to the Reference Pricing decree for natural resource exports, introduced in 2023, as being met with controversy.

In this regard, the CMM emphasises the need for a more efficient mining cadastre and the resolution of taxation issues, such as value added tax reimbursements and reference pricing bottlenecks.

“Improvements are needed [in] the mining cadastre at the National Institute of Mines (INAMI), with the aim of streamlining licence application processes, reducing fees and simplifying share transfer approvals,” points out Klok.

While significant progress into cadastre developments is expected in the short- to medium-term, no specific timeline has been set, he explains.

Future Prospects

In terms of its future, Klok tells Mining Weekly that Mozambique’s graphite and lithium sectors show significant potential.

Currently, the country hosts two graphite mines – the Balama mine and the Ancuabe mine, with the former having a yearly production capacity of about 350 000 t.

Located in the northernmost province of Cabo Delgado, the Balama mine is reportedly the largest natural graphite mine in the world, according to Statista.

Despite being the third-largest graphite-producing region globally, Mozambique’s actual production is less than a third of its installed mining and processing capacity, indicating substantial room for growth, notes Klok.

However, he laments that the development of new graphite mines is hindered by market oversupply and security concerns in the Cabo Delgado province.

While lithium mining in Mozambique is in its infancy, Klok says the mining of the mineral “holds great promise” – evidenced by the recent entry of Bombay Stock Exchange-listed explorer and developer Decan Gold Mines, with its acquisition of a majority stake in five lithium blocks in Mozambique.

Separately, to increase the benefits of its mineral resources, Mozambique is considering policies to promote local beneficiation and industrialisation, points out Klok.

One proposed strategy is banning the export of unprocessed minerals, though Klok notes concrete policy and legislative proposals in this regard have yet to be made public.

“The CMM stresses the importance of developing such strategies in collaboration with the mining industry to ensure competitiveness,” he says.

Klok further highlights the need for supportive infrastructure and human resources, stating “the discussion should shift to what Mozambique, as a country, can do to enable a competitive national industry on the back of its mineral sources”.

The mining sector in Mozambique faces several challenges that need addressing to improve the business climate.

These include enhancing the efficiency of the mining cadastre, expanding physical infrastructure, and developing long-term policies and legislation, says Klok.

He tells Mining Weekly that the CMM is actively working to raise awareness of the mining industry’s contributions to the economy and advocating for measures that encourage growth.

“The formal part of the mining industry already directly employs over 10 000 people. If growth is encouraged, then it could employ several times this number in the future,” he notes.

Further, expanding infrastructure such as roads, electricity supply and railways is crucial to unlocking Mozambique’s full potential, adds Klok.

“While Mozambique’s mining sector presents numerous opportunities, realising its full potential requires addressing existing challenges and implementing supportive policies. The collaborative efforts of the government, industry stakeholders and the CMM will be key to fostering a conducive environment for sustained growth and investment in the mining industry,” he concludes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation