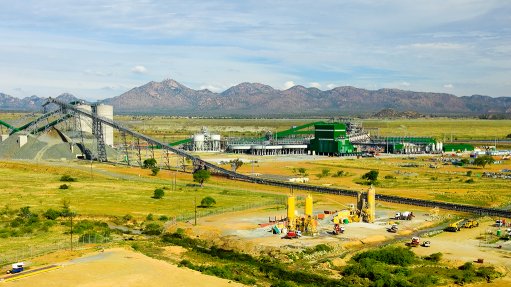

Andrada reports higher tin, tantalum production for the quarter ended May 31

Aim-listed Andrada Mining, which owns operations in Namibia, has announced a 14% quarter-on-quarter increase in saleable tantalum concentrate production to 9 t for the quarter ended May 31, which is the first quarter of its 2025 financial year.

In its quarterly operational update released on June 21, the company reported a year-on-year increase in ore processed to 237 976 t, from the 217 189 t of ore processed in the quarter ended May 31, 2023.

Tin concentrate production also increased, to 364 t, from the 359 t produced in the prior comparable quarter, while contained tin production increased to 223 t, from 216 t in the prior comparable quarter.

Plant availability increased to 93%, compared with 91% in the same period a year prior. Additionally, the realised tin price increased from $25 149/t in the prior comparable quarter to $30 839/t of contained tin for the quarter under review.

Management has maintained its guidance on costs despite the introduction of royalty charges and ongoing mining cost increases. The mine and plant performance are expected to remain stable during the current financial year as the pre-concentration circuit and Continuous Improvement 2 (CI2) initiatives are implemented.

Enhanced plant performance following the completion of the expansion programme is expected to reduce operational costs.

Management guidance on quarterly average C1 costs is maintained at between $17 000/t and $20 000/t of contained tin, with costs of $18 899/t recorded for the quarter under review.

The guidance on quarterly average C2 costs is maintained at between $20 000/t and $25 000/t of contained tin, with costs of $23 452/t recorded for the first quarter of the 2025 financial year.

The guidance on quarterly average all-in sustaining cost (AISC) was maintained at between $25 000/t and $30 000/t of contained tin, with an AISC of $28 774/t recorded for the quarter under review.

Meanwhile, the unaudited cash balance as at May 31 was $15.2-million.

“Exposing planned ore zones has reduced our stripping ratio at Uis. Coinciding favourably with our expansion of both tin concentrate and contained tin production, we are ideally positioned to capitalise on the tin price rally that began in April.

“Given the diversity of the minerals within our mining licences, we have broadened the scope of our strategic process beyond just the Uis mining licence. The expansion of the scope has the potential to unlock multiple partnership opportunities across our portfolio of assets.

“This process is progressing well, and we look forward to providing an update. We remain highly optimistic for the remainder of the year based on the value that will be unlocked across the portfolio,” Andrada CEO Anthony Viljoen said on June 21.

The operational review highlighted a 10% year-on-year increase in ore processed, although it remained unchanged quarter-on-quarter at 238 000 t. The plant processing rate was slightly lower at 134 t/h, compared with 135 t/h in the first quarter of the 2024 financial year and 137 t/h in the fourth quarter of the 2024 financial year, primarily owing to plant outages during the quarter.

These outages, caused by a malfunction in the ore preparation section, were swiftly repaired and are not expected to recur. Consequently, tin concentrate production decreased to 364 t, from 371 t in the fourth quarter of the 2024 financial year, and contained tin decreased to 223 t from 231 t.

However, the year-on-year tin concentrate and contained tin tonnages marginally increased, reflecting the positive impact of the expansion project undertaken in the 2023 financial year.

The pre-concentration circuit expansion update revealed that the XRT ore sorters from ore sorting technology company Tomra and the crusher circuit from original-equipment manufacturer Metso are expected to be delivered in the second half of the 2024 calendar year, with construction targeted for completion in the first quarter of the 2025 calendar year and commissioning starting in April 2025.

Engineering company MetC Engineering has begun the detailed plant design in line with the planned project timelines, Andrada said.

The ore sorting pre-concentration circuit will be installed parallel to the front end of the existing processing plant to minimise disruptions to tin and tantalum production. The CI2 programme initiatives are ongoing and have been aligned with the plant expansion project timeline to ensure optimal production output.

Development of the lithium pilot plant paves the way for integration into the existing tin processing plant, the company stated.

Further assessment and modelling of the integrated plant have increased the planned petalite production tonnage from the current 30 000 t/y to between 40 000 t/y and 50 000 t/y.

Studies on the integration of the lithium circuit are under way, targeting the production of petalite using near infra-red ore-sorting to process discard material from the XRT ore sorters.

Meanwhile, Andrada pointed out that tantalum prices had been increasing steadily since mid-May owing to conflict in the Democratic Republic of Congo, which has restricted supply from selected key mining areas. Increased purchasing interest from smelters is also expected to support elevated prices.

Regarding Bank Windhoek funding, Andrada confirmed that the administrative processes related to the finalisation of the conditional £7.6-million agreements between subsidiary Uis Tin Mining company and Bank Windhoek are progressing as planned.

The requisite offer documents were signed by the company and Bank Windhoek within the conditional 30-day period. The deal teams for all parties have been engaged and several workstreams have started. The company expects to conclude the funding agreement by the third quarter of the 2024 calendar year.

Andrada’s cash decreased from $22.2-million at the end of February to $15.2-million as at May 31, mainly owing to payments for the preconcentration circuit project and increased ore stockpiles in preparation for the expanded plant capacity.

The conclusion of the Bank Windhoek agreement is expected to provide $9.7-million towards general working capital, ongoing exploration, metallurgy and study workstreams. Discussions regarding other funding options with several global lenders are ongoing to enhance the optionality on project execution. All near-term projects are fully funded.

To mitigate financial risk amid recent tin price volatility, Andrada concluded a hedging instrument with Standard Bank Namibia Limited for the first 20 t of contained tin shipped every month from June this year to May 2025, at a fixed price of $33 000/t.

The tin price rally, which started in April, was driven by supply tightness owing to decreased exports from Myanmar and Indonesia, as well as declining inventory in China. Speculative interest has also contributed to the rally, with experts cautioning against an excessively bullish view of future pricing.

The London Metal Exchange tin spot price increased from $25 450/t on January 2 to above $30 000/t on April 10, peaking at $35 275/t on April 22. The average daily price from April to date has been about $32 700/t, with a quarterly figure of $30 900/t.

The hedge covers about 30% of the quarterly production based on contained tin production in the 2024 financial year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation