Photo by: Ivanhoe Electric

Name of the Project

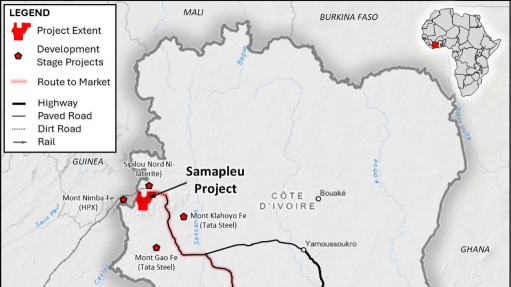

Samapleu-Grata nickel/copper project.

Location

Western Côte d’Ivoire.

Project Owner/s

Ivanhoe Electric (60%) and Sama Resources (40%).

Project Description

The 2024 preliminary economic assessment (PEA) outlines the potential for a conventional openpit mining operation supporting 86.5-million tonnes of modelled mill feed, together with 1.62-million tonnes of direct shipped laterite material entirely from the Grata, Main and Extension deposits, and the Sipilou Sud Laterite deposit.

Over the 16-year life-of-mine, the project is forecast to produce an average of 38 627 t/y of a 26% copper concentrate and 55 119 t/y of a 13% nickel concentrate through a process plant with a capacity of 5.5-million tonnes a year.

This will be achieved through a conventional process that focuses on flotation to produce separate copper and nickel concentrates, together with cobalt, platinum, palladium and gold as by-products.

Average nickel metal in concentrate of about 7 165 t/y and copper metal in concentrate of about 10 043 t/y is envisaged.

The PEA covers only the Grata, Main and Extension deposits, and the Sipilou Sud Laterite deposits, which together with the proposed mine infrastructure, covers only about 3% of the 835 km2 project area.

This provides ample opportunities for exploration upside and expansion opportunities, including at the known mineralised zones at Yepleu and Draba.

The polymetallic nature of the Samapleu-Grata project means that it has the potential to produce not only a nickel concentrate but also a high-quality 26% copper concentrate that is on par with the copper concentrate produced from primary copper mines.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The PEA estimates a pretax net present value of $463-million at an 8% discount rate and an internal rate of return of 28.2%, with an after-tax payback of 3.8 years.

Capital Expenditure

Initial capital costs are estimated at $338-million, including a contingency of $61-million.

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Ivanhoe Electric investors, tel +1 480 656 5821 or email info@ivanhoeelectric.com.