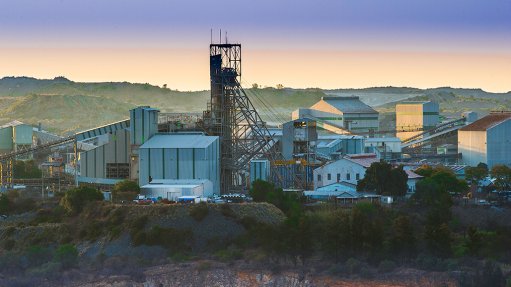

Petra Diamonds' Cullinan mine, in South Africa

London-listed Petra Diamonds has generated $38-million of revenue in its seventh tender cycle for the year, having sold 337 064 ct.

This brings revenue for the 2024 financial year to $366-million, with 3.15-million carats sold, compared with revenue of $324-million and 2.32-million carats sold in the prior year.

Revenue for the year was 13% higher compared with the prior financial year, despite prices averaging lower at $116/ct for the reporting year, compared with $139/ct in the prior year.

Petra advises that like-for-like prices were down 3.8% at $111/ct in the seventh tender cycle, compared with the sixth tender cycle’s average price of $118/ct, owing to continued softness in demand for coarser diamonds, specifically diamonds between 1 ct and 10 ct in size.

Average like-for-like prices in the year under review were 12.4% lower, compared with prices achieved in the 2023 financial year.

In addition to rough diamond sales, Petra also benefited from the sale of three partnership diamonds, which resulted in Petra’s profit totalling $1.3-million in the reporting year, compared with a profit of $1.4-million realised in the prior financial year.

The company expects a subdued market through to the end of the current calendar year and its price assumptions for the 2025 financial year remain unchanged at between $125/ct and $135/ct for diamonds from the Cullinan mine, between $98/ct and $105/ct for diamonds from the Finsch mine and between $200/ct and $225/ct for diamonds from the Williamson mine.

The Cullinan and Finsch operations are based in South Africa, while the Williamson operation is in Tanzania.

Petra’s Koffiefontein mine, in South Africa, is on care and maintenance in preparation for the asset’s disposal.