Photo by: Sovereign Metals

Name of the Project

Kasiya rutile/graphite project.

Location

Central Malawi.

Project Owner/s

Sovereign Metals and Rio Tinto.

Rio Tinto invested in Sovereign in July 2023, resulting in an initial 15% shareholding and options, and expiring within 12 months of initial investment, to increase its position to 19.99%. Under the investment agreement, Rio Tinto will provide assistance and advice on technical and marketing aspects of Kasiya, including on Sovereign’s graphite co-product, with a primary focus on spherical purified graphite for the lithium-ion battery anode market.

Project Description

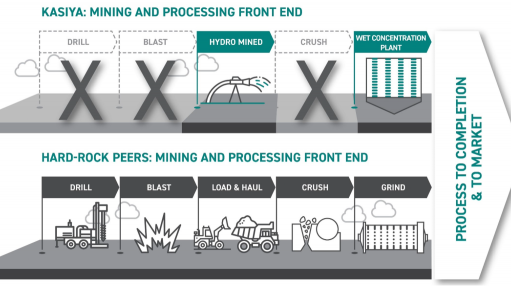

Kasiya is the biggest natural rutile deposit and second-largest flake graphite deposit in the world.

A prefeasibility study has confirmed a potentially major critical minerals project, with an extremely low carbon dioxide footprint delivering significant volumes of natural rutile and graphite while generating significant economic returns.

The proposed large-scale operation will process 24-million tonnes of ore a year to produce an estimated 245 000 t of natural rutile and 288 000 t of natural graphite a year at steady state, for an initial mine life of 25 years.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $1.61-billion and an internal rate of return of 28%, with a payback of 4.3 years from the start of production.

Capital Expenditure

Capital costs to first production are estimated at $597-million. Expansion capital is estimated at $287-million.

Planed Start/End Date

Not stated.

Latest Developments

Sovereign Metals has reported that pilot site construction for the ongoing pilot mining and land rehabilitation programme (pilot phase) is on schedule, with groundworks under way.

The construction fleet is on site, with groundwork to excavate the water storage pond and build the test areas under way.

Eight water extraction boreholes have been commissioned and are delivering water to the site, with the filling of the water storage pond to follow.

Site equipment is advancing at 5 000 m3/d of earth. The fleet comprises four excavators, 20 trucks and a support fleet, including two bulldozers and a motor grader.

A perimeter fence around the 9.9 ha pilot site has been erected to maintain the necessary health and safety standards.

Sovereign’s strategic investor, Rio Tinto, is assisting in establishing health and safety protocols, and in implementing them on a day-to-day basis.

Key contractors and consultants have also been appointed across all major disciplines essential for the pilot phase. The phase will be an educational opportunity for project stakeholders, Sovereign has said, pointing out that it will undertake a series of stakeholder visits and consultations for this purpose.

Sovereign’s objective is to restore land after mining to conditions that achieve the same or better agricultural yields than existing land uses and crop yields.

The pilot phase is expected to demonstrate to local communities the successful rehabilitation of land for agricultural use after mining. Land rehabilitation will, therefore, form an integral component of the ongoing optimisation study.

Results will also enable Sovereign to determine optimal excavation and backfill approaches, providing critical information for the upcoming definitive feasibility study.

Key Contracts, Suppliers, and Consultants

SocialEssence (continued development of Sovereign’s stakeholder relations, social performance objectives and its CSR framework).

Contact Details for Project Information

Sovereign Metals, Tel +61 8 9322 6322, or email info@sovereignmetals.com.au.