Wacker Neuson Sub-Saharan Africa has launched a dynamic Finance Program in collaboration with WesBank, a division of FirstRand Bank Limited. This program offers flexible financing options for essential compact equipment, providing businesses with the opportunity to invest in critical machinery without straining their finances. The initiative aims to support businesses in overcoming current economic challenges and driving growth in their respective industries by offering tailored financial solutions.

"We are aware that in this challenging and sluggish economic climate, many businesses lack the financial capacity to purchase the necessary capital equipment to fulfill their contractual obligations," says Stefan le Roux, Sales Manager for Wacker Neuson Sub-Saharan Africa.

The Finance Program is available to eligible Wacker Neuson customers and dealer partners in South Africa until 31 December 2024. The Finance Program provides benefits such as preferential interest rates and structured repayment terms, subject to terms and conditions.

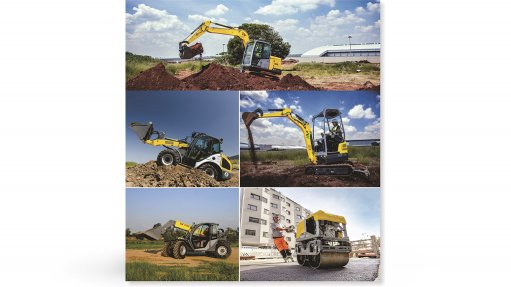

Customers can apply for financing for the following Wacker Neuson machines under the Finance Program: excavators (ET66, ET75, and electric EZ17e), telehandlers (TH627 and 3507), wheel loaders (5085 and 8155) as well as the RD7Hf walk-behind roller. “We have adapted the pricing of these machines especially for this Finance Program,” confirms le Roux, adding that for a qualified customer, a minimum deposit of only 15 percent of the total purchase price of the equipment is required.

To learn more about this program, including the terms and conditions, customers can contact Wacker Neuson, any of its dealer partners, or WesBank.

“We are excited about this Finance Program, which aligns with our customer-focused approach. By streamlining equipment financing, we provide our customers with the necessary machinery to grow their businesses. This, in turn, will lead to job creation and positively impact our country’s economy,” concludes le Roux.

WesBank is a division of FirstRand Bank Limited and an authorized Financial Services and Registered Credit Provider. NCRCP20. Terms and conditions apply.