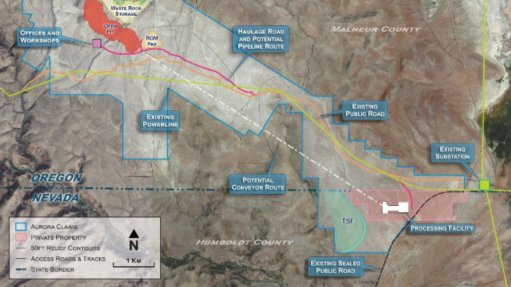

Proposed site layout of the Aurora uranium project

ASX-listed Aurora Energy Metals has delivered a scoping study that demonstrates a viable pathway to developing its namesake uranium project in the US state of Oregon.

Using a spot price base case of $90/lb, the Aurora project demonstrates strong cash flows of A$502-million, a net present value of A$232-million and an internal rate of return of 25%.

Over 11 years, Aurora will produce 1.15-milion pounds a year of uranium oxide (U3O8).

Chairperson Peter Lester said on Wednesday that the indicative project development timetable aligned with an anticipated U3O8 supply deficit over the next decade, underpinned by the recently passed US legislation to ban imported uranium from Russia from 2028 onwards.

The study has identified a “relatively simple” processing flowsheet that is based on beneficiation and atmospheric leaching, with scope to further improve recoveries.

Aurora plans to process ores on the company’s private land in Nevada to simplify permitting, use existing infrastructure and reduce capital requirements.

The production of a loaded resin for off-site toll treatment to final product has also been adopted, bringing further efficiencies to the project.

The project will require a capital investment of A$248-million and is set to produce at a cash operating cost of $46.10/lb.

“The widely held expectation of a uranium supply ‘crunch’ in the US provides the comfort of high projected demand for our product from the domestic market.

“Additionally, we are confident this heightened focus on domestic mineral production will not only help expedite projects like ours but also attract government support for financing new uranium mines,” said Lester.